Commercial Truck Financing with Bad Credit Doesn’t Have To Be Difficult

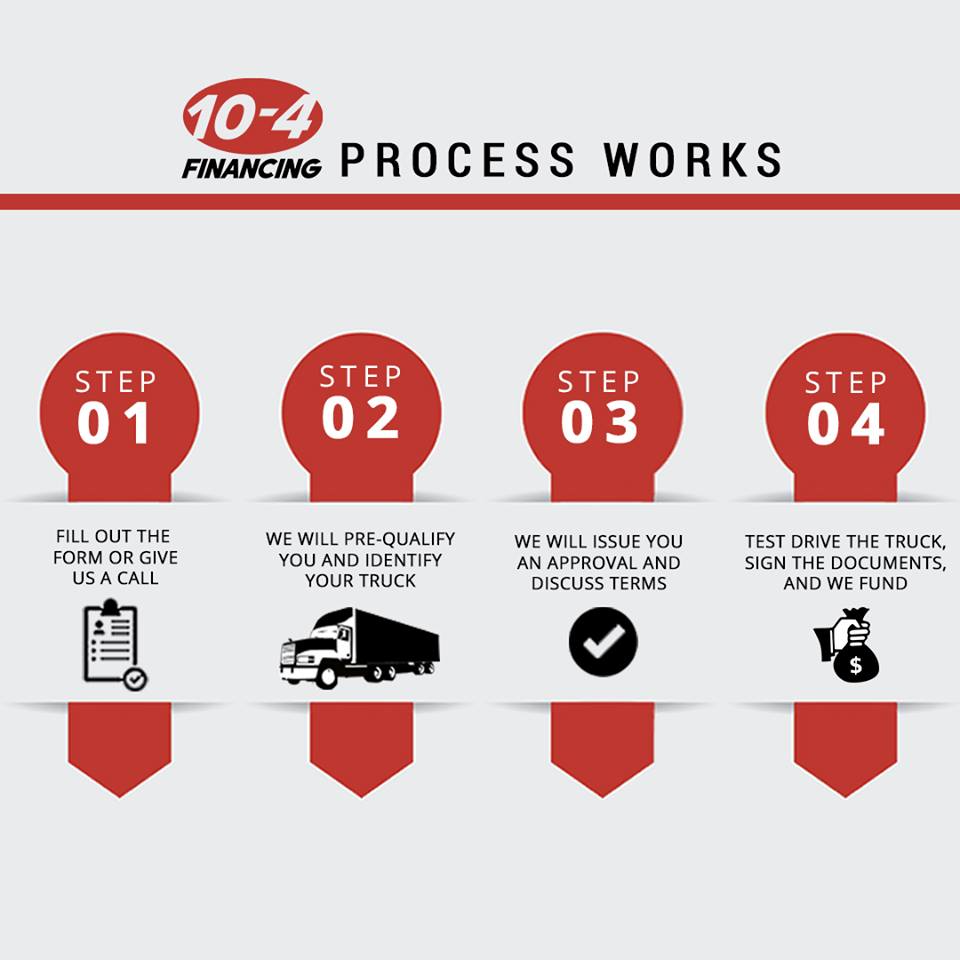

Our financing team is experienced in helping with bad credit truck loans. Learn about the advantages of working with us and call today to start the 10-4 process!

Pick from Any Dealership in the US

Application Only Programs up to $150K

Pre Qualify Quick & Easy

Down Payments Start at 10%

If you are currently in the market to finance a new semi truck, but you are dealing with bad credit, it’s important to procure professional financing services to ensure you are provided with affordable, advantageous results. Subprime lending is a hot topic when it comes to loans such as home mortgages, but when it comes to commercial truck financing with bad credit, drivers are finding that the terms provided to them simply aren’t worth the costs.

10-4 Financing, LLC specialists in semi truck financing across the continental United States. Our experienced team works with dozens of partners and more than 20 lenders to help all of our customers find the best fit for their unique situation.

If you’ve struggled to finance your semi truck because you have bad credit, be sure to catch up on our blog post below to discuss the importance of your credit score. We’ll highlight how this number is determined, as well as the value of our professional services.

IMPACT OF GOOD CREDIT VS BAD CREDIT IN SEMI TRUCK FINANCING

Your FICO score (originally Fair, Issac and Company) is a numeric value ranging from 300 to 850, compiled by three credit reporting bureaus that account for a wide range of financial factors in your background. This credit score reading is utilized by more than 90 percent of financial institutions worldwide, and will ultimately determine how successful you are in acquiring subprime lending.

Financing a semi truck, home, or startup business will depend largely on how good your credit score is. Scores in the 700s will yield much more advantageous terms compared to borrowers with scores in the 500s or lower.

DETERMINING YOUR CREDIT SCORE

Many Americans know the importance of obtaining a high credit score, but few know how this number is configured. FICO will weigh five key categories when determining your score, with the importance of each category varying by the individual. Generally, though, your FICO score is comprised of:

- Payment history (35%) — If you can make your monthly payments on a regular basis, your score will increase over time.

- Accounts owed (30%) — The amount of credit available to you is important, as well as the amount of money currently owed. Borrowers with a high ratio of debt to available credit will likely see lower scores.

- Length of credit history (15%) — Providing a long history of responsible credit payments helps to show lenders that you are more likely to continue being timely on all of your credit lines.

- New credit lines (15%) — Individuals who frequently open new lines of credit will see a dip in their FICO scores. It’s important to open new accounts, but be sure to spread out your plan to avoid looking like a risky borrower.

- Types of credit (10%) — Lenders like to see a healthy mix of credit types. Auto loans, student loans, home mortgages, credit cards, and more can build your portfolio and increase your credit score.

The Challenges of Affording Subprime Financing

When it comes to financing a semi truck with bad credit, many drivers face the challenge of securing terms that are affordable while investing in a vehicle that is reliable enough to provide a steady income. If you are dealing with subprime lending, it can prove frustrating trying to find a lender that will take on your loan with ideal terms.

If you have bad credit and have looked for semi truck financing, chances are that you noticed how expensive subprime lending can be.

Drivers trying to get a truck loan with bad credit are often required to spend a lot more money to purchase their vehicles, with challenges including:

- Higher interest rates — Those with lower credit scores will be deemed a higher risk, raising interest rates over the life of your loan. Bear in mind that a one-point difference in your rate can lead to considerable cost differences over the years.

- Larger down payments — In order to make life easier, many truckers are required to put more money down to mitigate loan risks.

- Reduced inventory options — Commercial truck financing depends largely on your buying power, with higher credit scores resulting in more flexible financing options.

FINANCING SEMI TRUCKS WITH BAD CREDIT

10-4 Financing, LLC specializes in commercial truck financing for those with bad credit. We understand that life happens, and that you are more than just a number. Our team works with numerous lenders nationwide to offer a range of versatile truck finance options. Our team can help you find the best truck, trailer, or revolving business line of credit needed to grow your operations. If you’ve been struggling to purchase the right semi truck, our subprime program is the perfect answer!

We offer industry-leading truck financing for those with bad credit, helping drivers with credit scores as low as 500. Many industry professionals find that the subprime terms offered by other lenders are more costly than the income brought in by the truck itself, creating a no-win scenario. 10-4 Financing relies on our proven process to find you the best truck at an ideal price. We know a good deal when we see one!